Explain How the Financial System Minimizes Individual Risk.

Once youve worked out the value of the risks you face you can start looking at ways to manage them effectively. Your financial-risk mitigation strategy needs to account for all areas of your business from human resources to operations.

Pdf Environmental Risk And Management Strategy The Implications For Financial Institutions

Minimize this risk by using different passwords for different services and changing them every six months.

. The financial manager measures organizational efficiency through proper allocation acquisition and management. -aims to limit the risk of default of individual institutions. We call this individually optimal allocation O and we call the associated probability of individual failure p.

A well-functioning financial system provides ways to handle uncertainty and risk. As we reshape the incentives and constraints for risk-taking in the financial system we have to recognise that regulation has the potential to make things. The Risk Sharing Role of Banks.

For example there may be a new minimum wage that must be implemented immediately. Financial system risk refers to the probability of breakdowns in financial intermediation. There is also financial risk from accidents or other destructive events.

A risk register or template is a good start but youre going to want a robust project management software to facilitate the process of risk management. It is a pathway to attain goals and objectives. Through diversification of loan risk financial intermediaries are able to mitigate risk through pooling of a variety of risk profiles and through creating loans of varying lengths from investor monies or demand deposits these intermediaries are able to convert short-term liabilities to assets of varying maturities.

Compliance risk involves companies having to comply with new rules that are set by the government or by a regulatory body. The financial risk most commonly referred to is the possibility that a companys cash flow will. Concerned with Monitering Identifying and Acting to remove risks that affect the stability of the financial system as a whole.

The individually optimal allocation for any given bank in the sense of minimizing risk for expected return is to distribute equal amounts into each asset class. To deal with such risks companies need to implement a real-time feedback system to know what its customers want. When all banks are at the individual optimum we call the configuration uniform diversification.

-risks are viewed as independent of each other bottom up -the robustness of individual institutions is supposed to guarantee that of the system. Financial risk management is an ongoing concern whether youre running a startup or a mature business. When all banks are at the individual optimum we call the configuration uniform diversification.

It can only accept cash payments. There are four key areas of modern systemic risk. It improves operational efficiency by providing a timely supply of fund.

It can tighten the credit terms ie. -microprudential supervision requires v specific skills. Risk management is complicated.

Insurance companies help to protect against this risk by pooling the money of all the insured to pay out the few claims that will arise in the pool. You perform a Risk Analysis by identifying threats and estimating the likelihood of those threats being realized. Through private sector and government intermediaries including the system of social insurance the financial system provides risk-pooling and risk-sharing opportunities for both households and business firms.

Risk identification mainly involves brainstorming. Here is the risk analysis process. Monitor and take action to Remove or Mitigate systemic risks to UK financial System 2nd goal.

It facilitates the efficient allocation of risk-bearing. It might seem like a hassle but. Support economic policy of the government.

The company can reduce its credit risk with the following methods. Financial risk generally relates to the odds of losing money. Financial Policy Committee FPC 2 main objectives.

A business gathers its employees together so that they can. The following noticeable importance is found. Payments are required on shorter notice penalties can be.

By a financial market and the second and third problems can best be solved by intermediaries. It is the main constraint and disruptor of macro trading strategies. So a financial system must provide accurate risk assessments to induce lenders or investors to invest their money.

Mitigating financial risk however is not just about managing cash flow and preparing for rainy days. This chapter discusses the micro- and macro-prudential regulation of banks and investment firms as a means of protecting depositors and investors as well as minimizing systemic risk. Risk analysis is a qualitative problem-solving approach that uses various tools of assessment to work out and rank risks for the purpose of assessing and resolving them.

ProjectManager is a cloud-based tool that fosters the collaborative environment you need to get risks resolved as well as provides real-time information so. They argue that banks will predominate in an emerging financial system while the informational advantages of markets may allow them to develop in a mature financial system. 1 In the regulated banking sector vulnerability arises from high leverage and dependence on funding conditions.

The importance of financial management is vital to an organization. After providing an overview of the objectives of micro- and macro-prudential regulation and the causes of systemic risks it looks at the taxonomies of micro-prudential macro-prudential and dual. The individually optimal allocation for any given bank in the sense of minimizing risk for expected return is to distribute equal amounts into each asset class.

We call this individually optimal allocation O and we call the associated probability of individual failure p. This may include choosing to avoid the risk sharing it or accepting it while reducing its impact.

Pdf Important Factors Of Financial Risk In The Sme Segment

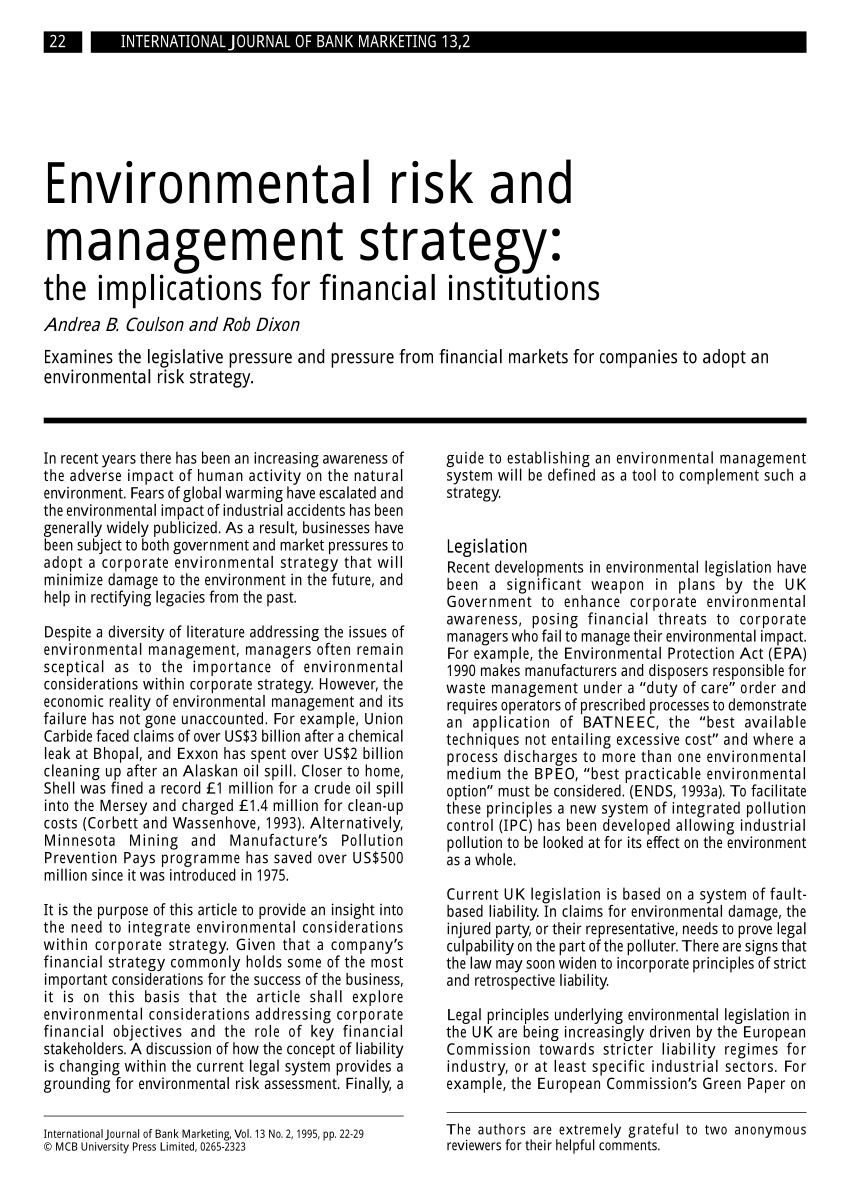

Sustainability Free Full Text How Does Financial Literacy Promote Sustainability In Smes A Developing Country Perspective Html

Pdf Corporate Governance Of Banks And Financial Institutions Economic Theory Supervisory Practice Evidence And Policy

Revolutionizing Trade Finance With Blockchain Technology Mpg

How Can We Control Systemic Risk World Economic Forum

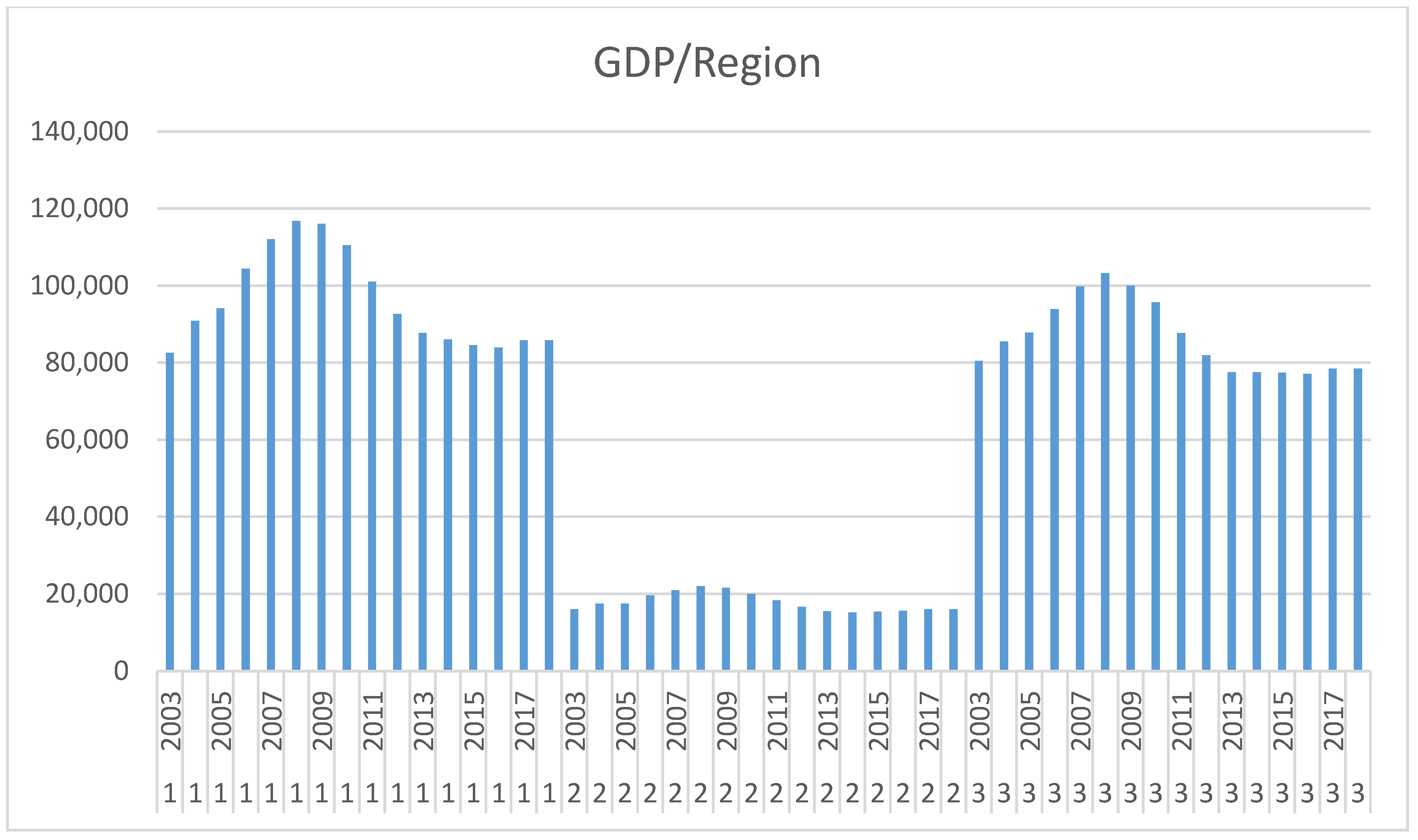

Jrfm Free Full Text Banking Development And Economy In Greece Evidence From Regional Data Html

Quality Assurance Template Excel Tracking Spreadsheet Free With Software Quality Assurance Report Template Data Quality Report Template Professional Templates

How Can We Control Systemic Risk World Economic Forum

Pdf The Effect Of Islamic Financial Inclusion On Economic Growth A Case Study Of Islamic Banking In Indonesia

Shift Handover Report Template Google Docs Word Template Net Free Resume Template Word Resume Template Word Report Template

Financial System Risk Systemic Risk And Systematic Value

Eco Efficiency And Financial Performance In Latin American Countries An Environmental Intensity Approach Sciencedirect

Pdf Financial Risk Identification Based On The Balance Sheet Information

How Can We Control Systemic Risk World Economic Forum

Business Case Results Deliver Proof Build Confidence Reduce Risk Business Case Business Case Template Financial Analysis

Forex Profit Matrix System In 2021 Forex Strategy Forex System Options Trading Strategies

Pdf Banks Financing The Green Economy A Review Of Current Research

Compliance Regulatory Compliance Revenue Cycle Management Compliance

Comments

Post a Comment